Ethereum Price in CAD: A Comprehensive Guide for 2024

Ethereum Price in CAD: A Comprehensive Guide for 2024

Introduction to Ethereum and Its Growing Popularity

Ethereum (ETH) is one of the most well-known cryptocurrencies, second only to Bitcoin in terms of market capitalization and global recognition. Ethereum’s blockchain technology supports not only the transfer of ETH as currency but also smart contracts and decentralized applications (dApps). This versatility has led to its widespread adoption in various industries, ranging from finance and gaming to supply chain management and governance.

With cryptocurrency markets expanding across the globe, there is increasing interest in the price of Ethereum in various national currencies. For Canadian investors and crypto enthusiasts, knowing the Ethereum price in CAD (Canadian Dollars) is critical for making informed investment decisions. This article will dive deep into Ethereum’s price dynamics, factors influencing its value in CAD, and the broader implications for Canadians.

What is Ethereum?

Before diving into Ethereum’s price in CAD, it’s essential to understand what Ethereum is and why it’s important. Launched in 2015 by Vitalik Buterin, Ethereum is a decentralized platform that allows developers to build and deploy smart contracts. Unlike Bitcoin, which is primarily a digital currency, Ethereum serves as a global computing network, capable of executing code (smart contracts) and facilitating decentralized applications.

Ethereum uses a cryptocurrency called Ether (ETH), which fuels transactions and operations on the network. Ether is used as a medium of exchange for computational power on the platform, thus driving demand for the cryptocurrency.

Importance of Ethereum Price in CAD for Canadians

For Canadian investors, keeping track of the Ethereum price in CAD is crucial, as it directly affects investment portfolios and trading strategies. Given the fluctuating nature of both cryptocurrency prices and foreign exchange rates, Canadians must understand how to convert Ethereum into their national currency.

Knowing the current price of Ethereum in CAD enables Canadian investors to:

- Buy and sell Ethereum at optimal prices.

- Calculate gains or losses in their local currency.

- Make informed decisions about converting ETH into CAD.

- Hedge against potential currency risks.

Factors Affecting Ethereum Price in CAD

1. Global Ethereum Price Trends

Ethereum’s global price, often expressed in USD, is the primary driver of its value in CAD. The price of Ethereum is subject to various market forces, including supply and demand, global adoption of blockchain technology, and regulatory decisions. For example, major institutional investments in Ethereum or announcements about decentralized finance (DeFi) platforms using Ethereum can significantly affect its price.

2. Exchange Rates Between CAD and USD

Since Ethereum is typically priced in USD on international exchanges, fluctuations in the CAD/USD exchange rate will directly impact its CAD price. A stronger Canadian dollar will make Ethereum cheaper for Canadian investors, while a weaker CAD will make it more expensive.

3. Canadian Regulations on Cryptocurrencies

Government regulations in Canada concerning cryptocurrencies can also influence the price of Ethereum in CAD. For instance, favorable tax policies or government initiatives promoting blockchain technology could boost demand for Ethereum. Conversely, strict regulations or taxation policies may have the opposite effect.

4. Transaction Fees and Network Congestion

Ethereum is known for its dynamic transaction fees, also referred to as gas fees. When the network is congested due to a high number of transactions or smart contract executions, gas fees tend to rise. For Canadian users looking to buy Ethereum or execute transactions on the Ethereum blockchain, these rising fees can significantly impact the overall cost in CAD.

5. Technological Developments (Ethereum 2.0)

Ethereum is in the midst of a major technological transition to Ethereum 2.0, which aims to improve scalability, security, and sustainability. One of the main updates includes a shift from a Proof of Work (PoW) consensus algorithm to Proof of Stake (PoS). These technological upgrades have the potential to affect the global price of Ethereum, which in turn would influence its price in CAD.

Historical Ethereum Price Trends in CAD

2015-2017: The Early Years

When Ethereum was first launched in 2015, its price was significantly lower compared to where it stands today. In CAD, Ethereum traded for less than $5. However, by 2017, Ethereum began gaining attention from both developers and investors, leading to its price climbing to approximately CAD $500 during the 2017 bull run.

2018: The Crypto Winter

After the peak of the 2017 bull market, Ethereum, like other cryptocurrencies, entered a period of decline. By late 2018, Ethereum’s price in CAD had dropped to around $150 due to a market-wide correction, often referred to as the “crypto winter.”

2020-2021: Bull Market Surge

Ethereum’s price began to rebound significantly in 2020, driven by increasing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs), many of which were built on the Ethereum blockchain. By May 2021, Ethereum’s price reached an all-time high of around CAD $5,500.

2022: Market Correction

In 2022, Ethereum, along with the broader cryptocurrency market, experienced a downturn, dropping to around CAD $1,600. However, by the end of 2022, Ethereum had stabilized, driven by positive developments in its transition to Ethereum 2.0.

How to Track Ethereum Price in CAD

Tracking Ethereum’s price in CAD is simple and can be done through various platforms:

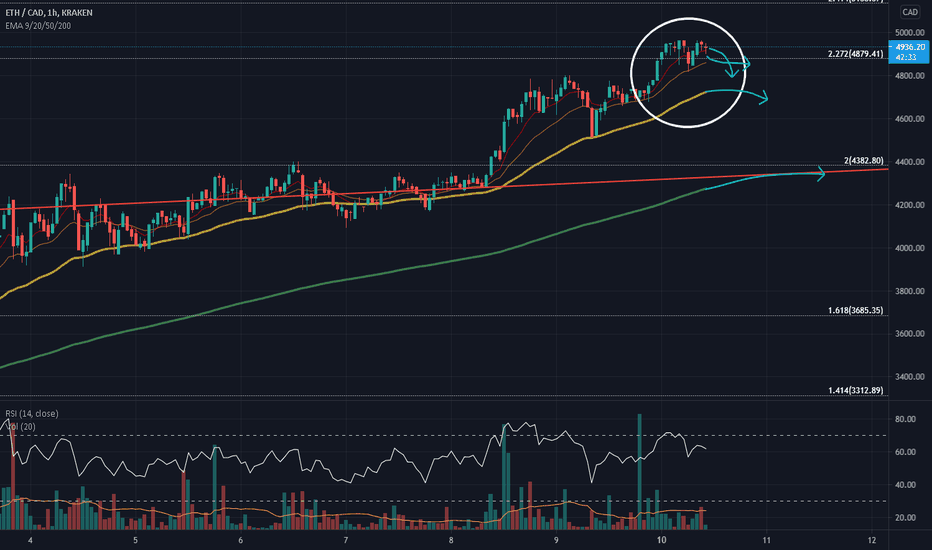

- Cryptocurrency Exchanges: Exchanges like Binance, Coinbase, and Kraken allow users to view the Ethereum price in CAD and trade ETH against CAD.

- Price Aggregators: Websites like CoinMarketCap and CoinGecko display real-time price data in CAD, along with price history charts and market analytics.

- Mobile Apps: Many crypto wallet apps also provide real-time price tracking for Ethereum in various currencies, including CAD.

- Financial News Websites: Major financial websites such as Bloomberg or Yahoo Finance offer cryptocurrency price tracking in CAD.

Investing in Ethereum: Is It Right for You?

Pros of Investing in Ethereum

- Growth Potential: Ethereum’s blockchain technology has a wide range of use cases, from decentralized finance to NFTs. As these sectors grow, Ethereum’s value could increase further.

- Liquidity: Ethereum is one of the most liquid cryptocurrencies, meaning it can easily be bought and sold, including in CAD.

- Institutional Interest: Institutional investments and Ethereum’s upcoming upgrades (Ethereum 2.0) provide a solid foundation for future price appreciation.

Cons of Investing in Ethereum

- Volatility: Like all cryptocurrencies, Ethereum is highly volatile. Price fluctuations in both ETH and the CAD/USD exchange rate can affect the value of your investment.

- Regulatory Risk: Changes in regulations in Canada or globally could either positively or negatively impact Ethereum’s price.

- Network Challenges: Ethereum currently faces scalability and fee-related issues, although these are expected to be addressed in Ethereum 2.0.

Converting Ethereum to CAD: A Step-by-Step Guide

If you’re looking to convert Ethereum to CAD, here’s a simple step-by-step guide:

- Sign Up on a Canadian-Friendly Crypto Exchange: Platforms like Bitbuy, Coinberry, and Newton offer direct ETH to CAD conversions.

- Complete KYC Verification: Most exchanges require you to verify your identity before buying or selling cryptocurrencies.

- Deposit Ethereum: Transfer your Ethereum from your wallet to the exchange’s wallet.

- Sell Ethereum for CAD: On the trading platform, select the option to sell Ethereum for CAD. Confirm the amount and execute the transaction.

- Withdraw CAD: Once your Ethereum is sold, withdraw your CAD to your bank account through the exchange’s withdrawal options.

Future Predictions for Ethereum Price in CAD

The future of Ethereum’s price in CAD will likely depend on several factors, including:

- Completion of Ethereum 2.0: If Ethereum 2.0 successfully improves scalability and reduces transaction costs, Ethereum’s price could see upward momentum.

- DeFi and NFT Growth: Continued expansion in decentralized finance and NFTs could drive demand for Ethereum, pushing its price higher.

- Global Market Trends: Broader market trends, such as Bitcoin’s performance and regulatory developments, will also impact Ethereum’s price in CAD.

Conclusion

Understanding the Ethereum price in CAD is essential for Canadian investors and crypto enthusiasts. By staying informed about the factors that influence Ethereum’s price, both globally and locally, investors can make more educated decisions regarding their portfolios. As Ethereum continues to evolve with technological upgrades and increasing adoption, it remains a compelling asset for those interested in blockchain technology and decentralized finance.

While the cryptocurrency market remains volatile, the long-term prospects for Ethereum appear promising. Whether you are a long-term investor or a trader looking to capitalize on price movements, keeping a close eye on the Ethereum price in CAD will ensure you stay ahead in this rapidly evolving market.

Post Comment